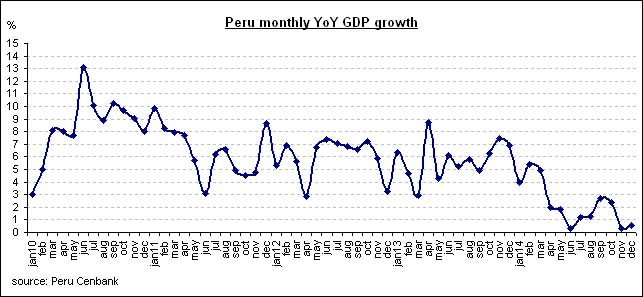

Depending on who you talk to or read these days, the Peruvian economy is robust, or slowing. While officials remain upbeat & expect economic growth to be close to 5%, they missed the mark by nearly half last year. (see Why the Peruvian Economy Matters to the World) While the continued decline of the Sol vs the USD is supportive of export growth, the fact that 50% of all debt in Peru is denominated in dollars will offset any gains from a lower national currency.

All is not rosy in the export sector:

From Gestion: (via Bing Translator – any authors’ corrections in parenthesis)

Exports from Peru to the United States totaled US $6,079.30 billion in 2014, representing a decline of 25.20% compared to those recorded in the previous year, which accounted for the second largest fall in Latin America, according to Latinvex.

Full article here. (Spanish)

The agricultural sector has been the main winner in the Treaty of free trade (agreement FTA) with the United States. Peruvian exports to this country (have) grown 118% between 2009 – year which entered into force the agreement – and 2014 to spend $580 million to $1.263 billion. Thus, this market receives 30.3% agricultural sales, mostly fresh (products.)

However, this good performance can be dulled if the U.S. Government approves the proposal made by the service of Animal health inspection and plant (Aphis, by its acronym in English (to) increase the charge for the inspection of each container of perishable products subject to health treatment, which would be US$ 280 to US$ 375.

Approval of this proposal – whose phase to receive opinions already ended-, Peruvian exports, especially those of fresh asparagus, which must be fumigated to reach United States, would be seriously affected.

Lionel Arce, CEO of Agroindustrial complex Beta, says that this new rate more expensive selling price of the product – which on average is US$ 1.10 per kilo – and removed the little margin of profit generated.

—

The $95 may not seem like much of an increase relative to the size of a shipping container, but many importers have already lost money in the past year as their fresh vegetables lay waiting off of whatever west cost port they were coming into. This was due to the still ongoing port strike slowdown which has delayed shipping times dramatically since a six-year contract between the International Longshoreman & Warehouse Union and Pacific Maritime Association, which represents shipping companies, expired July 1, 2014.

From Bloomberg:

A six-year contract between the International Longshore and Warehouse Union and Pacific Maritime Association, which represents shipping companies, expired July 1. While talks have been under way since May, signs point toward a deal, said Anthony Scioscia, former senior vice president of labor relations of A.P. Moeller-Maersk A/S’s Maersk Agency U.S.A., who is now a consultant to the industry.

The longshoremen and the association representing shippers at 27 West Coast ports have been discussing how to retrain and preserve jobs for dockworkers as automation reduces the number of dock positions, as well as salaries and work rules. A strike or lockout could cost the U.S.economy $2 billion a day, according to the National Retail Federation and National Association of Manufacturers.

—

Ship transport costs are quite low today, but even so, the profit margins on container loads are typically razor thin, and every cost or delay reduces the viability of the import. It can cost as much as $300/day to sit in the port. Meanwhile, the product can degrade or spoil. (We personally experienced this in November/December – ouch. See Waiting for the Coffee.)

Exchange rate goes up to S/.3,088 and BVL Rises in the opening

The Peruvian Sol continues to plumb new 6 year lows, but the stock market opened higher yesterday.

Almost daily the Central Bank has had to sell dollars to stave off the continued fall of the Sol.

The Central Reserve Bank (BCR) could apply a further reduction in the benchmark interest rate at its meeting in March, a month after return inflation to the target range, according to the estimates of the Department of economic studies at Scotiabank.

According to the weekly report from Scotiabank, the next movement of the benchmark interest rate has a bias downwards and, not long ago, BCR President Julio Velarde, pointed out that there is room to reduce the benchmark interest rate as inflation returns to the range goal.

—

Central Bank President says Rate Cuts Possible

Peru central bank President Julio Velarde talks about the possibility of a fifth interest rate cut since 2013 after Finance Minister Alonso Segura cut his forecast for economic growth this year.

via Velarde Says Peru Has Room to Cut Rates Again (Spanish) – Bloomberg Business.

—

While any lower interest rates would result in a lower Sol vs Dollar exchange rate, a boon for exporters, any gains will be offset due to the fact that 50% of all debt (private/corporate/government) is in dollars. Those owing in dollars will see their payments rise.

Peru posted the slowest economic growth in five years in the fourth quarter as interest-rate cuts and fiscal stimulus failed to revive South America’s fastest growing economy of the last decade.

Gross domestic product increased 1 percent from the same period a year earlier, the nation’s statistics agency said in an e-mailed report. The median estimate of 12 analysts surveyed by Bloomberg was for a 1.1 percent rise. GDP increased 1.8 percent in the third quarter.

Fixed capital investment fell 1.8 percent last year as a drop in copper and gold exports fueled a record trade deficit.

President Ollanta Humala authorized wage increases and one-off bonuses for government workers in the second half of 2014 in an attempt to revive growth, while the central bank cut its key rate to a three-year low.

via Peru GDP Grew at Slowest Pace Since 2009 in Fourth Quarter – Bloomberg Business.

—

Peru is a commodity exporter, and with the China slowdown, will continue to see deflation in that sector. Falling interest rates may aid some exporters, but all who have borrowed in dollars will be spending more on the exchange.

The glory days of the commodity miracle are over, and as foreign investment slowly leaches out of the country like light sand in a gold pan, the Peruvian economy will more and more succumb to the dollar trap that has attached to the entire economy.

©2015 Ben Gangloff

You might also enjoy:

Why the Peruvian Economy Matters to the World

Will the Hot Money Leave Peru?

Peruvian Economy Facing Stiff Headwinds

What’s the Future of the Peruvian Economy?

Did you enjoy this page? Have questions? Would like information on something to be posted here? Please drop us a line, or sign up for our email list in the box to the right.