A long dreamed railroad connecting the Atlantic coast of Brazil to the Pacific coast of Peru may finally become a reality. Meanwhile economic news is mixed in Peru. The dollar has remained relatively stable vs the Peruvian Sol lately, but it may just be a pause before the dollars rise again according to Charles Hugh Smith of the Of Two Minds Blog.

Peru, China, Brazil poised to sign off on new continent-spanning railway – Peru this Week

A new railway, stretching more than 5,000 kilometres from the Atlantic to the Pacific, is set to start soon with China’s premier coming to South America next week. (Photo: El Comercio) Related Articles Chinese Premier to make official visit to Peru

It has long a South American dream, the development of a railway connecting the Brazilian coast to the Pacific Ocean in Peru is set to get underway with an agreement between the two countries and China nearing fruition.

The tripartite, US$10 billion project will be on the table when Chinese Premier Li Keqiang visits Brasilia next week, reports ITS International.

The Ministry of Transport and Communications has custody of the Peruvian part of the joint project which will take an estimated six years to complete.

The transcontinental railway would stretch for 5,300 kilometres through several Brazilian states, through the Amazon and over the Andes.

Non-governmental organizations have expressed concern, with over 600 indigenous communities en route, including 15 living in voluntary isolation. Dialogo Chino reports that conservationists fear environmental impact assessments will be done poorly and fast-tracked.

The railway will link primary producers and miners in Peru and Brazil with the booming Chinese market, cutting back on the logistical costs of trade with East Asia and allowing Chinese products to reach the Atlantic coast more easily.

The railway would almost certainly add impetus to expand soy production, fertilizer output, and other industries in the forest and desert.

Economic News Mixed

Sales of Appliances fell 5% on Mother’s Day (El Comercio)

(Via Google Translate – with editors corrections for clarity)

The appliance industry has not had a good year so far. The increase in consumer prices of between 8% to 10% – because of the exchange rate and the slowdown of the economy in a modest first summer campaign, and then in a less auspicious campaign Mother’s Day.

In the latter, the household sector decreased 5% compared to 2014, says Javier Ugarte, general manager of Indurama. “This was caused by lower turnover of products and also by a consumer trend to acquire more personalized gifts at this time, which used to represent nearly two months of sales,” explains.

As Indurama, the picture is similar. Ugarte said that sales decreased 2% versus the campaign for Mother’s Day earlier. “The seizure of the south and a short campaign in Lima played against.”

In that vein, Alan Kahn, his business manager, acknowledged that the campaign was lower than expected in July and trusts that can be improved with an increase of 3% and 4% compared to 2014.

Peru: Exports to the U.S. fall in first quarter – Peru this Week

The United States is one of the largest importers of Peruvian products and, with vast investments in traditional products such as oil, has been a reliable source of income for Peru. However, with the recent economic crisis around the world and environmental concerns, exports to the United States have experienced a slow down.

Exports to the United States fell 20.9% in the first trimester of 2015 compared to the same period last year, according to Gestion.Oil, a main figure in investments and trade between these two countries, is among the traditional products that fell. As for non-traditional exports, clothing and agricultural products represented a large loss for the value of exports to the United States as well.

Non-traditional exports fell 1.2% worth US$ 672 million, while traditional exports were worth US$ 570 million. This brings the trade between Peru and the United States in the first quarter of 2015 to a total worth of US$ 1.242 billion, according to ADEX.

The Business Intelligence System ADEX Data Trade concluded that the primary Peruvian exporters to the United States in this period were Minera Yanacocha, YMHE & Asociados, Pluspetrol Perú Corporation, La Pampilla Refinery, Minsur, Tecnofil, Mining Company Miski Mayo, Petróleos del Perú Petroperú, among others.These companies represent Peru’s major producers of crude oil. Therefore, the general slump in exports was primarily due to drops in these products. For example, according to ADEX, gasoline tetraethyl fell 57% compared to 7% in 2014, crude oil fell 78% compared to 12% in 2014.

More recent recovery in petroleum & metals prices has helped the export sector somewhat, but any new strengthening in the dollar will reduce export values & also slow consumption as import prices rise.

BCP: Peru’s economy grew 2.7% in March, higher than expected, Tia Maria on Hold

According to Banco de Cedito del Peru, the economy grew 2.7% in March which was a considerable improvement over this years otherwise lackluster growth. This will probably be the bright spot of the year as continued weakness in the Sol robs the average consumer of buying power.

Meanwhile, the proposed Tia Maria copper project in southern Peru is on hold for the moment due to violent protests against the project. Over $340 million has already been invested by Southern Cooper (Grupo Mexico) in the project, but further progress will be delayed for at least 60 days while the company tries to assure the local population of the benefits. So far, that hasn’t been effective. With returns on investment falling as the mineral sector has fallen on hard times, the incentive for new capital outlays for mining are bleak, and the ongoing confrontations with locals has to make some in the boardrooms nervous.

Dollar to Resume Upward Climb?

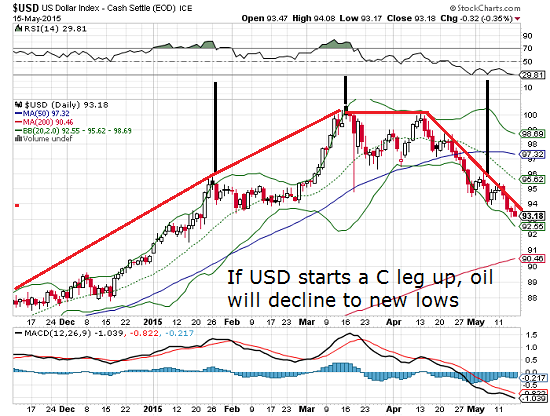

Longtime correspondent Charles Hugh Smith expects to see another resumption of the rise in the dollar and a corresponding lowering of oil (and other commodity) prices.

Musings Report 20: Life’s Most Important Dramas Are Being Disrupted

The dynamics of oil and USD are complex. But as I discussed in a previous Musings this year, there are solid reasons to view the current decline in USD as a B-leg retrace that will be followed (shortly) by a much larger C-leg higher. If this comes to pass, we can expect oil to plummet below recent lows around $43/barrel to the $30s.

This would reduce export prices and increase trade deficits for Peru. Consumers, businesses and even the Peruvian government have substantial outstanding debts based in dollars. Each increase cuts more and more capital from the economy.

China continues to be an influence in South America, and a train from east to west would be a wonder, let’s see if the world economy cooperates…

©2015 Ben Gangloff

You might also like:

Peru Ranked Third for Adventure Tourism, Here’s Why

Inti Raymi: Cusco’s biggest festival