As I first began to think about this post I imagined that the line “Why the Peruvian economy matters to the world,” would be considered by some in high finance circles to be somewhat comedic relief, maybe like a night out at the improv comedy club for Keynesian economists and bankers.

It’s not to say that Peru’s economy is so large or anything like that, being just 51st in nominal GDP worldwide, (source) but rather that its run to glory is so typical of what has happened to little countries all over the world since 2008. As the “free” Federal Reserve dollars sloshed around the planet searching for anywhere to grow faster, faster, those same dollars found a happy home in many emerging and smaller nations. Peru by itself is just one of the many, but the sum total of debt between all those “little” emerging nations is a significant sum that could easily cripple the banking system.

Peru is Still Booming, But the Bloom is Off

You see, here as I write from Lima, Peru the boom has continued since a slowdown in 2008. They don’t have here the constraints of the US; retiring boomers who must now focus on retirement in this difficult investment climate (for the fortunate ones that have any investments that is.)

With a median age of 27.5 years in Peru, it finds itself in one of the recent hottest economies in the world; there are babies and small children everywhere. Housing has skyrocketed as the demand from the recently prosperous working class youth building the ever growing upward city and the new young professionals who benefitted from a good (and still affordable) educational system are investing in the many apartments in Lima. At least half of these loans are made in dollars.

Lima and the country in general has seen vast improvement in the last decade. The economic crisis in 2008 hit everyone here, but economic growth resumed at the blistering pace that it had seen since 2002, and in 2012 housing prices jumped an astounding 30% in one year. It was a heady time of rapid growth, and apartment buildings (what we would call condos in Arizona) began to crowd the already crowding skies over the various districts in Lima.

The Peruvian Sol was strong & getting stronger. No need to worry about that loan being in dollars,” it’ll only get cheaper” was heard on the streets. For a while the Sol strengthened and all those dollar loans were even easier to pay off. No need to worry, prices will keep going up. A city lot in Pueblo Libre (a decent district in Lima) could fetch $350,000-400,000 & nobody blinked.

By 2013, the bloom was off the rose, and mortgage applications began to fall according to our friends at the banks. Today, at the beginning of 2015, one senses a realization that things are slowing down. More projects seemed to have stalled, perhaps for lack of funds, and others never seem to start. More and more appear to have empty apartments for sale in every part of the city, where once one could drive for a long time without seeing a “For Sale,” or “For Rent” sign in block after block of towering apartment homes.

Yet, the projects continue today, the city noisily hums, but one feels that one day soon the market will hit a wall, probably just as all these 20 story apartment units rising like mushrooms after the spring rains are about to be finished. Meanwhile, it feels eerily like 2006-2007 in the US real estate market. It’s still smoking hot, but everyone knows that it’s not the same, and is starting to wonder when the shoe will drop.

Anecdotally, it’s staggering to see the incredible growth in just the last seven years. It will be a bit of a problem for a young population who hasn’t experienced the hard times that have visited Peru before. They may not take kindly to the idea of being ruined financially.

When the construction boom slows as it must, then all those who borrowed construction loans made at 12-14% interest (some as high as 18%!) and in dollars will begin to be ground up alive as the interest begins to erode the shrinking equity in their buildings. The oversupply will result in falling prices not only due to quantity, but also by the fact the many will be facing foreclosure as those many loans made in dollars will continue to cost more every month. With the loss of employment looming for many in the construction trades & mining fields, there may be a large influx of properties for sale/rent entering the market as the overall marketplace becomes more worrisome.

These sudden turnarounds in real estate can appear at any time, but when the everything signals “bubble,” it’s fairly obvious, especially having just been through a real estate slowdown in the US (again.) It’s just a matter of timing for when the psychology will change. Like the old land guy once said, “when the phone just stops ringin, then you know it’s over…”

Car Loans

The man on the street who bought that Chevy or Ford (and most others) would have the choice of a loan: dollars or soles with your new car, “Ya know, the sol just keeps getting stronger…” whispers the car salesman (in Spanish of course) and lo and behold we have a brand new car owner. Congratulations!

Flash forward a couple of years & that 2012 car payment has risen by 20%. A little bit more of a stretch in a country where the minimum wage is less than $500/month.

Dollar Rising Rapidly – Economy Slowing

At the end of the year the local press Gestion in Lima published a report of a speech by Luis Miguel Castilla of the Ministry of Economy & Finance who had been with President Humala since his election, but resigned in September.

via Conoce el resumen económico del año | Economía | Gestion.pe (Original – Spanish)

The dollar soared upwards in the second half of 2014, having appreciated 4.5% since July due to the end of monetary stimulus in the US and signs of recovery in the economy.

Finally, the national GDP would have grown between 2.5% and 3% (half the originally estimated) in 2014, depending on how close(s) the year.

Just half of the expected growth. Not a surprise to anyone who has been following not only the spectacular fall in oil prices, but copper, iron ore, and even natural gas are all seeing production costs rise to meet and in some cases exceed their earnings.

The dollar here has been strengthening fairly rapidly, in part due to slower economic growth, but also due to some “shotgun” effects throughout the system because of the real stragglers (think Argentina, Venezuela, Greece, Italy, Spain) the latter of course show that even the recently mighty Euro is starting to reel after the (never-ending) Greek problems fail to cure themselves (to no one’s surprise, except Central Bankers of course.)

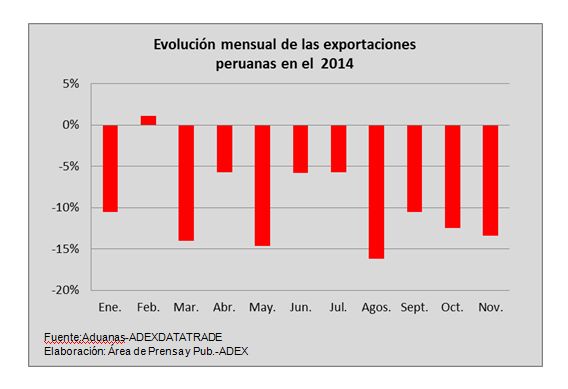

Peruvian Exports Fall in 2014

Here’s another vital part of the economy, exports:

2014 sure didn’t look very high growth to me. Now, truth be told there were some increases in other exports that are considered “non traditional,” but overall you see that the export picture looks glum. Minerals are approximately 15% of GDP here, so the drop in prices and related mining project investments is a blow to an economy that is already running a trade deficit.

One thing to note is that Peru is an oil exporter as well, and there has been much interest in expanding drilling into the Amazon regions. Besides some local resistance, the falling value of oil negates the benefits in many of the more recently planned projects. So, it becomes a double shock, loss of hard currency oil income & loss of economic benefit from the oil projects themselves (which we’re also seeing in the US.)

Mining in Peru

Copper is traditionally a bellwether for economic growth as it reflects commodity demand that rises as growth increases demand & prices rise. With the large scale commodity bubbles caused by relentless Central Bank money printing worldwide, we’ve seem much distortion in the metals markets and massive overinvestment in mining capacity.

Some are worried as Peru via Chinese investment will soon realize aspirations of becoming the second largest copper exporter in the world:

via Chinese companies invest $20B in Peru’s copper mines | CCTV America.

“Because the copper market is dominated by China it will not only make us increasingly primary export and therefore more dependent on mineral exports, in general terms, but more dependent on China in more specific terms and, therefore, increasingly exposed to the volatile nature of these markets,” said Carlos Monge, the Latin American coordinator at the Revenue Watch Institute.

While the Chinese for the moment appear to be moving ahead, time will tell if these projects will continue to be funded. Some of the more marginal projects have already been shelved.

Mining provides many higher paying jobs, not only for the miners, but the layers of administrators. engineers etc. that feeds into the overall boom environment in Peru. As the deflationary bust in commodities continues, these vital “middle class” jobs will be curtailed. The resulting social problems will greatly affect Peru and its ability to service its foreign debt.

Why the Peruvian Economy Matters to the World

As I said in the beginning, commenting that Peru’s economy matters to the world might be met by derision and laughter in some corners, but the reality is this: the emerging nations now make up nearly half of the world economy, so their fall into perdition will rock us in the US as well.

When countries either through ineptness or just old fashioned political corruption allow themselves to fall into the foreign debt trap, it is the beginning of a time of suffering for the people at large. The easy days of credit are followed by the painful nights of oppression and degradation as the noose of the bankers is tightened around the country. A vicious circle ensues crushing the hopes & sucking literally the potential for economic salvation out of the country as currencies weaken and the hot money suddenly remembers that yes Virginia, there is risk in the emerging markets.

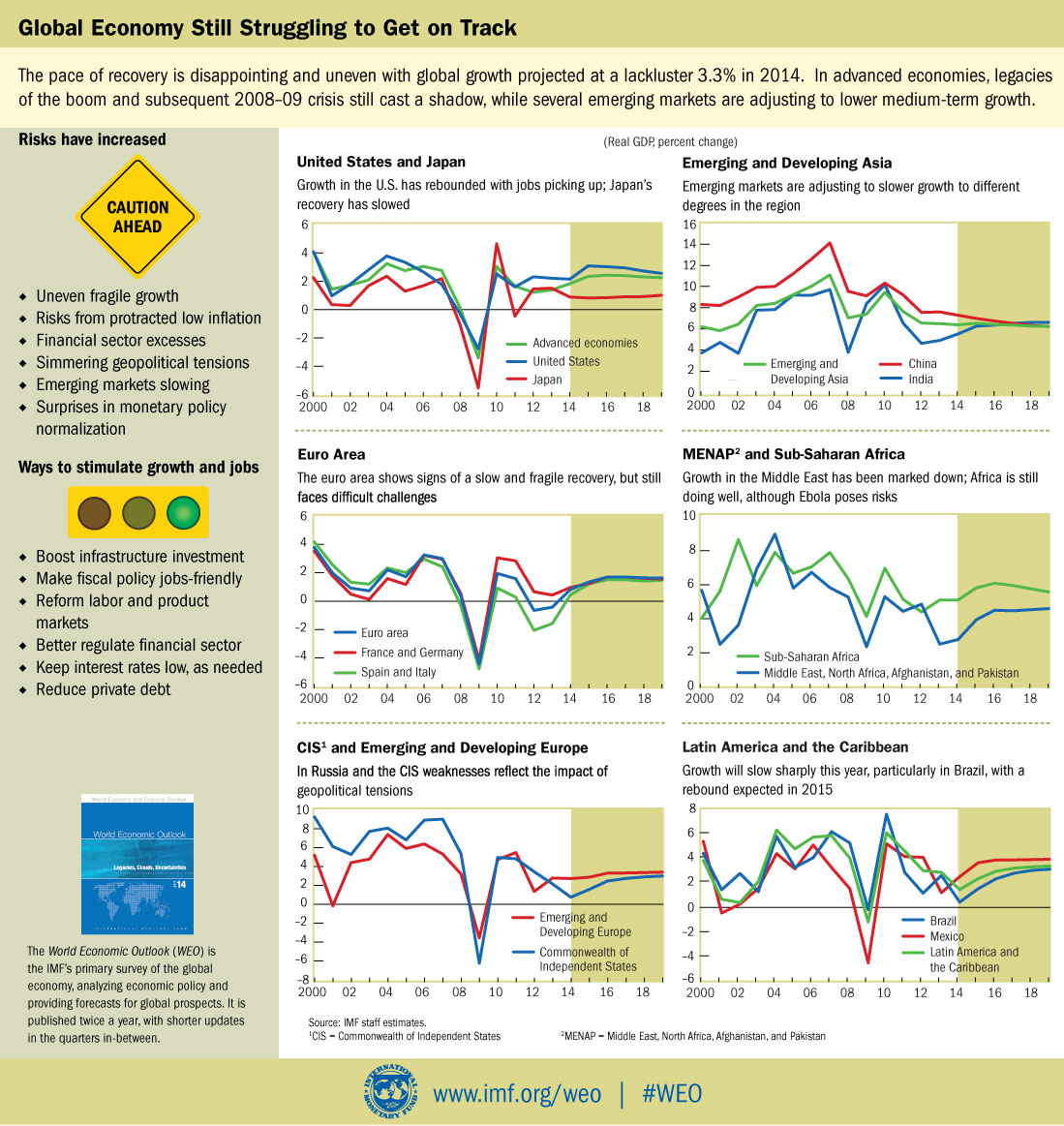

The recent above chart from the IMF seems to be wildly optimistic as the oil exporting nations in the middle east are fighting a tsunami of deficit spending caused by the unexpected precipitous fall in oil.

Meanwhile, Africa continues to struggle with not only Ebola, but with the rapid decline in metals prices. Europe may suddenly wake up to a Greek exit of the Euro, and on & on it goes. Over all, one has to remember that we are in the deflationary contraction of a debt fueled bubble of worldwide proportion.

Carry Trades

via The US Dollar Rally Has Crushed Brazil, Australia, and Now the S&P 500 | Zero Hedge.

The global currency market trades OVER $5.3 trillion per day.

Globally there are at least $9 TRILLION US Dollar shorts in the form of carry trades. When a carry trade unwinds, the damage is often catastrophic.

Now, all you have to do is look around the world to see where things are heading. From the once mighty Japan, to the emperors of debt in China, to the “should know better” Russians, and tinier but not insignificant economies like the Czech Republic or even Brazil, the noose is tightening and if one country gets in trouble then you’ll know that there are ten more, and so on. One little country becomes another domino that leads to another. Peru is one of the “cleaner shirts” in the laundry of world economies & it looks increasingly more fragile. That’s why the Peruvian economy does matter.

©2015 Ben Gangloff

You might also enjoy:

Will the Hot Money Leave Peru?

IMF Christine Lagarde Visits Peru

Peruvian Economy Facing Stiff Headwinds

Peruvian Sol Reaches S./3 vs $1 USD

What’s the Future of the Peruvian Economy?

The Biggest Economic Story Going Into 2015 Is Not Oil (Automatic Earth)

Did you enjoy this page? Have questions? Would like information on something to be posted here? Please drop us a line, sign up for our email list in the box to the right, or comment below.