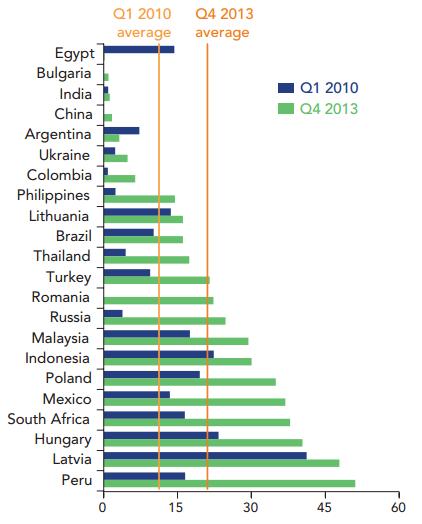

With emerging markets showing signs of stress after the end of QE, will Peru also see foreign money leaving the economy? With around 50% of all loans denominated in dollars, a sudden exit could leave Peru vulnerable.

Many Happy Returns

For many years, being a bond investor in Peru meant much better returns than in the US. As the money printing flowed steadily from Washington into the emerging markets, so also did the money flow to Peru. Coupled with steady increases in the value of the Peruvian Sol, it made for many happy returns.

Alas, the tide has turned, and with the drop in the Sol, and the general turmoil in the emerging markets, bond investors are no longer realizing outsized returns and are wondering if that money might do better at home.

Central Bank Moves to Reduce Foreign Loan Exposure

Peru has taken advantage of the easy money in the past few years and borrowed a tremendous amount of government funding, in fact now reaching nearly 50% of foreign funds invested in Sol bonds! Corporate borrowing also experienced a similar increase.

These investors are now crying as the Sol continues to fall (over 6% this year) and the big increases are fading away. In Peru the currency has actually fared well in comparison to other regional currencies.

Moreover, many of the other loans are denominated in dollars, and with the lower value of the Sol, dollar loans are becoming increasingly expensive to service.

Apparently, the central bank is concerned with this development as well:

From The Peruvian Times:

Around 50 percent of Peru’s total loans are in US dollars. Many people and companies borrowed in US dollars over the past decade as the sol steadily appreciated against the dollar, like other emerging market currencies.

For those earning their income in soles, it was beneficial to have loans in dollars as long as the Peruvian currency continued to strengthen. At one point, the sol reached almost 2.50 per dollar, and many economists thought it would continue to appreciate.

But earlier this year, that trend reversed as the US government announced it would start to pull back on its multibillion dollar bond buying program, known as quantitative easing, and as China’s economy weakened.

This has made it more costly to pay back loans in dollars for those with sol-denominated income. The sol is now trading at about 2.970, which is more than a 6% depreciation against the dollar so far this year.

For the Central Bank, this is one of the main risks for the health of Peru’s banking system.

“We have a problem that consists in still having a large part of the credit in dollars,” Velarde said.

“The projections for next year show that there will be more volatility, even though it is difficult to quantify,” he added. “We are taking measures to de-dollarize more credit.”

Velarde said he hopes the amount of dollar loans falls by 10% in the first half of next year, and by 20% in all of 2015.

Full Article Here.

—

Double Trouble

It’s a double whammy of investors who are invested in bonds of a declining currency and borrowers with loans in dollars with appreciating costs. What this will lead to is reduced investment & higher interest rates for emerging nations going forward.

From Zero Hedge:

As yields go up the value of these emerging market bonds goes down, resulting in losses for the investors holding them. The surge of the US dollar in recent months could magnify these losses: if the bonds are denominated in local currency they will be worth a lot less to US investors; otherwise, the borrowers will now have to work a lot harder to repay those US dollar debts, increasing their credit risk.

Concerns about the value of the US dollar pursuant to the unprecedented money printing by the Federal Reserve prompted many investors to diversify their currency exposure in the post-crisis period; the recent dollar strength is probably giving them some concern, if not regret. Then the commodity complex has been battered, depriving many of these economies from an important source of capital and foreign exchange. The high leverage further amplifies any financial risks. And the ripple effects from the ongoing spat with Russia can’t be helping either.

Full Article Here.

—

Looking into 2015

The press here remains optimistic with some economists still calling for 5% growth next year, but with the general volatility in the emerging markets it’s certain that many investors will be wanting higher yields looking forward. Between the slowing investor interest & the fall in commodity prices, the easy money party may be over. Higher rates & lower economic growth are on tap for 2015. If we are fortunate enough to avoid a rout in the emerging markets things may just slow. If everyone heads for the exits though, we could see things on the ground change rapidly.

©2014 Ben Gangloff

You might also enjoy:

Why the Peruvian Economy Matters to the World

IMF Christine Lagarde Visits Peru

Peruvian Economy Facing Stiff Headwinds

Peruvian Sol Reaches S./3 vs $1 USD

What’s the Future of the Peruvian Economy?

The Biggest Economic Story Going Into 2015 Is Not Oil (Automatic Earth)

Did you enjoy this page? Have questions? Would like information on something to be posted here? Please drop us a line, sign up for our email list in the box to the right, or comment below.